8 steps to buying a house in the Netherlands

Article provided by Mister Mortgage, an IN Amsterdam partner.

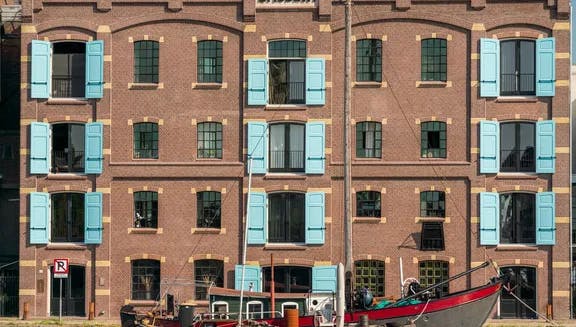

Every country has different rules and procedures for buying property. Needless to say, buying a house or apartment is a huge step and one that should be approached with careful consideration. So whether you’re new to the Netherlands, a first-time buyer, or both, it’s best to arm yourself with all there is to know about the process. Having a knowledgeable adviser can certainly help, too. Read on for our step-by-step guide to buying property in the Netherlands.

Find the right home

The first step on the road to finding an apartment or house is figuring out what you need, what you want and what you can afford. One of the most common mistakes made by first-time homebuyers is not understanding what they can afford. Online mortgage calculators can give you an idea of what could be possible, but it can be very different in reality. A mortgage adviser can help you discover your maximum mortgage and explain the additional costs related to a property purchase.

Next, you can start thinking about the areas and types of property that you like. Try I amsterdam’s MapitOut tool to get a sense of what is where and how to get around. Then familiarise yourself with the housing market where you’d like to live. You could contact a purchasing estate agent (aankoopmakelaar) or you could begin by looking around online, on sites such as Funda and MVA (the professional association for estate agents active in the Amsterdam Metropolitan Area). It’s also handy to use apps and web tools to save your search preferences and trigger notifications for new properties on the market.

Arrange a viewing and make an offer

Arrange a viewing with an estate agent as soon as you find a property. If you partner with a purchasing real estate agent, you have more chance that your eventual offer will be accepted. Do not forget to add the proviso ‘subject to raising finance’. There are no pre-approvals or mortgages-in-principle in the Netherlands, so you should make sure you will be able to secure a mortgage for what you are offering.

Sign a preliminary contract

Congratulations! Your offer has been accepted. Now it’s time to sign a presale agreement (koopakte). It must be drawn up by a lawyer and signed by both buyer and seller. As a buyer, you can protect yourself by signing a purchase agreement with a financial clause. This protects you if a mortgage lender decides to decline a mortgage application, enabling you to pull out of the sale without penalty.

Since you don't buy a home every day, the buyer also has a three-day cooling-off period to cancel the deal without reason. When the cooling-off period is over, the purchase agreement is binding to both parties. Typically after arranging your mortgage, a deposit of 10% of the purchase price is required – if you don’t have this saved, your mortgage adviser can arrange a bank guarantee.

Finalise your mortgage

Now is the time to arrange your mortgage (hypotheek). You could do this directly with a bank or you could use a mortgage adviser, who have the advantage that they can compare many different mortgage products available to you. Mortgage brokers in the Netherlands typically work with more than 20 lenders, while banks represent only themselves. You usually have three to six weeks to finalise a mortgage.

There are also different types of mortgages – annuity, linear and interest-only – and an adviser can help you figure out which works best for your circumstances. In the Netherlands, you can borrow up to 100% of the purchase price – but make sure you are aware of the additional closing fees that you will need to pay as part of the purchase, and which are not included in your mortgage.

These are usually marked as kosten koper and include the transfer fee (overdrachtsbelasting), notary fees and valuation fees. The transfer fee is either 2% or 8% of the purchase price, depending on your situation. First-time buyers aged 18 to 34 are currently exempt from the transfer fee, provided the purchase price is no more than €400,000.

Get a property valuation

Your lender will require a property valuation (taxatierapport) for the property to ensure it is worth what you are paying for it. In the Netherlands, it’s the buyer who has to organise and pay for the valuation. You should compare the fees of different providers and make sure you opt for an accredited company that will be accepted by your lender.

Organise a building survey

If you are buying a house rather than an apartment, and if it is an older house, it may be advisable to arrange a building survey (bouwkundige keuring). By having the house surveyed, you can avoid being taken by surprise by issues with the house later on. Surveys are less common for new builds or apartments.

Sign the contract at the notary

Nearly there! When your mortgage is approved, the final step is to sign a mortgage deed and a transfer contract (akte van levering) at the notary (notaris). Before that, your notary sends you a statement with the closing fees, which must be paid by the transfer date. The good news is that fees related to the mortgage are tax-deductible in the Netherlands.

If your Dutch skills aren’t so strong, the notary will require the presence of an interpreter to ensure you completely understand the terms of the contracts. Once every page has been signed and dated, the notary will inform the Dutch Land Registry (Kadaster) about the transfer, and you can walk away with the keys to your new home.

Move in!

Whether you rent a van and get some friends to help you carry your moving boxes, or go for a removal company that does it all for you, the day on which you move into your new home is bound to be exciting. If you are new to the Netherlands, there might be an additional surprise for you: did you know the Dutch often move their boxes and furniture through the window? A combination of big windows and narrow staircases has resulted in the development of this method, which employs a rope-and-pulley system or ladders and the large hook seen on the gables of many houses. We say you’ve not moved house until you’ve seen a sofa dangling outside your window on the fourth floor.

Need more advice? Get in touch with Mister Mortgage or explore more of IN Amsterdam’s partners.

Related articles

Why buy rather than rent a home in the Netherlands?

How to transfer a mortgage

6 insider secrets for securing a Dutch mortgage

Buy property in the Amsterdam Area

What short-term residents should bring to Amsterdam

The mortgage market in the Netherlands

Rent property in the Amsterdam Area

Tips on avoiding housing scams in Amsterdam

Overview of housing rights in the Amsterdam Area